There are dozens of countries that are working on national financial education strategies (NFES). Microfinance Opportunities (MFO) helped to write Rwanda’s Financial Sector Development Program and developed content for Uganda’s new website on financial inclusion, Simplify Money.

This blog highlights MFO’s work with Banca de las Oportunidades in Colombia to help the nation’s poor, displaced, and otherwise disadvantaged populations access financial education.

Banca de las Oportunidades (“Banca”) is the Colombian government’s policy mechanism for financial inclusion across the country. The agency aims to promote higher access and usage of formal financial services for Colombia’s low-income populations by creating committed networks of banks, NGOs, MFIs, and credit and saving unions. Banca works to coordinate the financial inclusion efforts of these multiple stakeholders. For instance, Banca also promoted mechanisms to scale up mobile banking services and has overseen the disbursal of conditional cash transfers through electronic savings accounts to encourage the use of mobile banking services. Such interventions combined with localized financial education build the capabilities and knowledge of low-income households to support their access to formal financial services.

The MFO-Banca Partnership

The partnership began in 2007 when Banca hired MFO to adapt modules from its Financial Education Core Curriculum (FECC) to the local Colombian context. MFO conducted market research, pilot testing, and refinement of the modules. Through this process, MFO was able to work with Banca to produce modules on Bank Services, Budgeting, Debt Management, Financial Negotiations, and Savings, all of which were tailored to local realities and Banca’s target demographic. MFO also provided technical assistance in the form of a Training of Trainers (TOT) workshop for Banca’s strategic partners. Banca continues to employ the same training methodology today in its financial education TOTs.

The MFO-Banca Financial Education sessions targeted recipients of conditional cash transfers in Colombia. From 2010-2013, Banca piloted the curriculum through the Creating a Saving Culture in Colombia program with The Department for Social Prosperity (DPS). It reached 40,000 Colombians in 12 administrative units (municipalities). The program combined financial education with cash transfers to savings accounts to promote savings on the part of the recipients.

In 2012, MFO adapted the curriculum from 16-hours worth of content to an abridged four-hour workshop to make it more applicable and accessible to lower-income households that participate in a broad set of Colombia’s social-welfare programs. The restructured financial education workshop was designed specifically for households living in extreme poverty and facing high financial risks, with limited time and resources to spend on receiving financial education. The abridged financial educational workshop accounts for the target population’s extreme financial vulnerability, instability of household income, and low access to formal financial services. It highlights the function and importance of tools like savings accounts and insurance in managing and mitigating financial risk. For this initiative, MFO developed new graphic cards and worksheets to accompany the abridged workshop.

Over the last two years, Banca de las Oportunidades has worked on a number of innovative interventions to broaden the outreach of financial inclusion efforts in Colombia. The national education strategy, El Camino a la Prosperidad, targets war victims and regions of consolidation affected by conflict and displacement. As of April 2014, 5,000 vulnerable individuals in 14 administrative units had been trained using MFO’s abridged financial education workshop; an additional 5,000 are expected to receive training by the end of 2014.

Banca has also been using a mass media strategy for communicating financial management messages. Communication channels include radio, television, theater, and live meetings. This program is expected to reach 800,000 people from 70 administrative units throughout Colombia.

Finally, Banca has coordinated a joint initiative with Colombia’s National Training Service (SENA in Spanish), which is a national public institution offering free and certified vocational tracks in manufacturing, trade, agriculture, mining, and cattle breeding to Colombia’s youth and adults. The initiative will integrate financial education into SENA’s Jóvenes Rurales Emprendedores program, which targets Colombia’s rural youth entrepreneurs. Using the TOT methodology adapted from MFO, Banca is working with 120 teachers at the national level, who will in turn train an additional 400 teachers to impart financial education to 10,000 students in the Jóvenes Rurales Emprendedores program in 2014. Banca and SENA expect to train an additional 80,000 students per year by 2017.

Results and Outcomes

The 2013 Annual Report on Financial Inclusion released by Banca de las Oportunidades and the Financial Superintendence provides a progress update on issues of access, usage, and consumer protection for clients of financial services in Colombia.

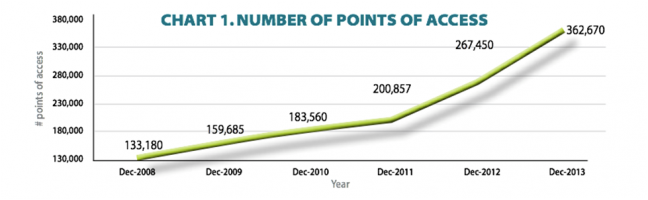

In terms of access, only three of Colombia’s administrative units lacked bank presence at the end of 2013, and only one lacked the presence of any type of financial institution. These measures indicate an increase in points of access to financial services across Colombia. From 2012 to 2013, Colombia established 50,000 new transaction points to provide access to financial services for clients that do not require use of debit or credit cards, tools the low-income segment of Colombia’s population typically lack.

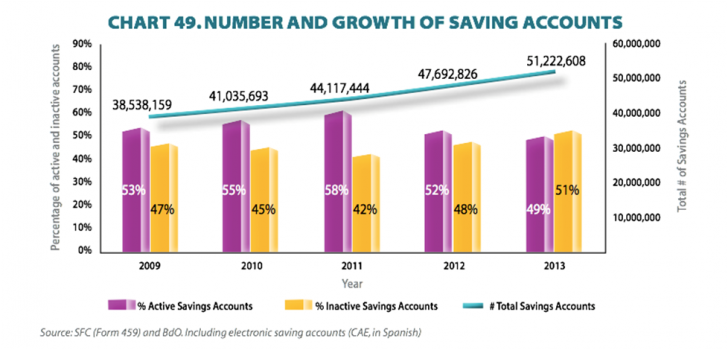

However, improvements in access are not mirrored by increased use of financial services. Out of 51.2 million savings accounts in Colombia, close to 51% are inactive, and this proportion has been increasing in recent years. According to the Banca report, Colombia’s low-income customers tend to be closely associated with stagnant account usage. The chart below illustrates the relationship between active and inactive savings accounts in Colombia from 2009-2013.

Nevertheless, according to testimony from a group of participants trained by Banca to be trainers in Buenaventura in September of this year, the outlook is positive. Banca has been focusing its efforts on change in savings behavior for Colombians. One Buenaventura participant, Maritza Garcia, shared, “the training was very important because it taught us how to manage our own finances. It was applicable to reality, to day-to-day life. The language was very simple. It will be easy to carry forward and teach to others.” The group of trainers left the session with a greater understanding of how savings behavior can improve personal finances and with a desire to disseminate what they had learned.

Recent reports indicate that Banca is very much tuned into trends in financial inclusion across Colombia, and making efforts to address persistent challenges that limit the achievement of full financial capability and the effective use of financial services. This year, the Government of Colombia established the Administrative National System for Economic and Financial Education to design and promote a national strategy for financial education. The intention of this strategy is to provide financial consumers with greater capacity to make decisions regarding access to and use of financial products. The strategy coordinates a variety of stakeholders, including Banca de las Oportunidades and the Central Bank, who are both permanent members in this initiative.

We at MFO look forward to following the important work carried out by Banca de las Oportunidades and to collaborating with Banca in the future.

References:

MFO would like to thank Paola Cuadros from Banca for her assistance in the development of this post.

2013 Annual Financial Inclusion Report: http://www.bancadelasoportunidades.com/contenido/contenido.aspx?conID=921&catID=339&pagID=1144