The Bangko Sentral ng Pilipinas Financial Inclusion Agenda

MFO began promoting financial education in 2006 as part of the Global Financial Education Program, now known as the Financial Education Core Curriculum (FECC) available online. Over the course of several years, MFO and its partner, Freedom from Hunger, worked to train different organizations across the globe on how to best provide financial education to low-income clients in their respective areas. These training sessions, referred to as Training of Trainers (TOT) workshops, lasted one to two days and trained local organizations how to successfully deliver financial education in their specific local context.

The Bangko Sentral ng Pilipinas (BSP) personnel participated in MFO’s TOT session in Southeast Asia, hoping to learn the necessary skills to tackle the financial inclusion challenges they were facing in the Philippines. While the BSP is primarily responsible for preserving price and banking system stability, it has embraced financial inclusion as an important policy objective. The BSP recognizes that a healthy financial system is more meaningful when it serves the needs of the majority, including the unbanked and underserved population. Reflecting on this approach, the BSP is asking important questions like:

- “How many Filipinos have access to formal financial services?”

- “Is financial access translating into actual usage?”

- “Are existing financial products relevant, of good quality and responsive to the needs of all financial consumers?”

In 2007, the BSP became one of the first central banks in the world to establish an office dedicated to financial inclusion when it institutionalized an Inclusive Finance Steering Committee (IFSC). The IFSC was created to provide strategic direction to financial inclusion goals and promote the synergy of various inclusion-related initiatives implemented by different operating units. The BSP financial inclusion agenda reflects the goals of the Philippine Development Plan (PDP) 2011-2016, which articulates the government’s vision of “a regionally responsive, development-oriented and inclusive financial system”. Financial education is likewise identified as a key component of the reform agenda in the PDP.

The Economic and Financial Learning Program (EFLP) is the BSP’s comprehensive initiative aimed at enhancing the financial literacy of target audiences. Several EFLP components specifically aim to bring the unbanked and financially excluded into the fold of formal financial services.

EFLP Interventions

The BSP adapted and simplified the content from MFO’s Financial Education Core Curriculum, which is available for free, to create EFLP modules that are relevant to and compatible with the Filipino context and the unique profile of participants. For example, in order to meet the needs of the rural program areas, the BSP designed portable flipcharts with key financial messages depicted by one graphic and one word in the national language. These modules apply the Adult Learning Principles to elicit active participation from participants, and they are still being used by the BSP today.

Under the EFLP, the BSP has partnered with the Department of Social Welfare and Development (DSWD) to deliver its learning modules to participants in the government’s conditional cash transfer program, known as Pantawid Pamilyang Pilipino Program. This government poverty reduction and social development program provides conditional cash benefits to poor households with children aged 0-14 with the goal of improving health, nutrition, and education levels. In 2013, the BSP and DSWD piloted the EFLP sessions, selecting participants nearing their transition out of the conditional cash transfer program to equip them with financial management skills.

The Pantawid pilot tests in 2013 demonstrated to the DSWD that the design and delivery of the EFLP modules were very well suited to the characteristics of Pantawid participants, including those who participated in the DSWD Sustainable Livelihood Program (SLP). The SLP enables participants of the Pantawid Program to manage sustainable microenterprises or links them to locally available jobs; ultimately, the program transitions participants out of the conditional cash transfer scheme. SLP participants receive the same financial literacy modules as Pantawid participants.

The BSP has also calibrated the modules into its own Training of Trainers (TOT) sessions to equip SLP field implementers with the skills and knowledge to effectively deliver the simplified financial literacy modules. To date, the BSP has completed four TOTs in Mindanao, identified by DSWD as a priority area.

Overall, EFLP seminars target the more vulnerable clientele of banks with microfinance operations, providing resources to segments of the population that have limited awareness of financial management and consumer protection. The seminars also target bank officers who work closely with clients, so they can, in turn, provide financial learning to colleagues and clients.

Measuring Financial Inclusion

Aligned with the BSP’s push to measure financial inclusion achievements, EFLP interventions emphasize feedback and evaluation. After each training session or seminar, an evaluation form is administered to measure self-reported acquisition of new or additional knowledge of personal finance management as a result of the session. Additionally, trainers conduct pre and post tests for seminar participants around financial management topics and provide time for an open forum at the end of a session to elicit feedback on the seminar.

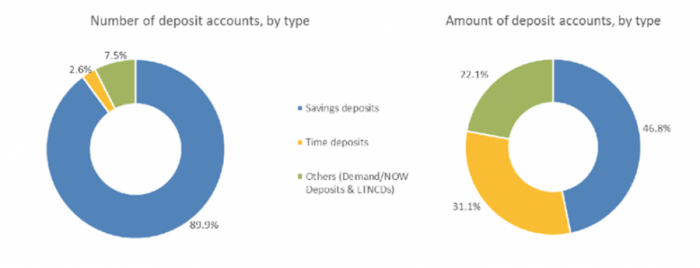

The BSP also consistently measures and reports national figures on financial inclusion. Figures reflect progress towards access and usage of financial services, in addition to a focus on consumer-centered products like e-money and micro-insurance. From 2012 to 2013, the total number of deposit accounts in banks increased by 9% to 45.5 million accounts. This growth also included an 8% increase in small savers, or deposit accounts below P15,000, and in 2013, small savers comprised 75% of all deposit accounts in banks. Overall savings behavior is improving of late, with almost 90% of all deposit accounts being savings accounts, and with 47% of the total amount of deposits being savings deposits.

In terms of refining financial products, e-money accounts like mobile wallets and cash cards grew 34% to 26.7 million from 2011 to 2013. Of the registered e-money accounts, 90% are considered active. Microinsurance products are on the rise too. The number of clients insured by rural banks grew by 153% from 2012 to 2013, reaching 1.4 million according to data from the Rural Bankers Association of the Philippines (RBAP).

These national figures suggest that the BSP’s expansion of financial inclusion programs in recent years, with special attention paid to financial education and learning, contribute to economic progress for the Philippines as a whole. We are looking forward to seeing where both the BSP and the Philippines will go from here.